One of the biggest challenges in trading is dealings with your emotions. It is often that we as traders get overly stubborn and fixated on specific trade and we end up paying for it.

Despite the fact I have been trading for many many moons I still remain a victim of this. As I have quite obviously said since February I have been extremely bullish the USD and extremely stubborn about trading it that way. For me February was a good month with over 1.2k pips worth of profit. However, the big blow came in March when I suffered from getting extremely aggressive on my bias and over trading.

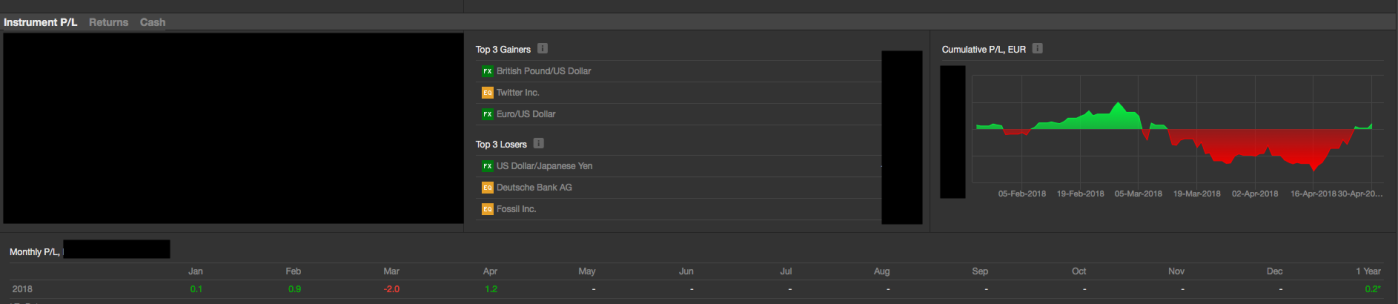

Below I will share my actual account information, something I normally wouldn’t do but I think it is a good way to be helpful.

Let us go over what is wrong in the chart above, excluding if the drawdown itself was significant or not (it wasn’t a small drawdown but admittedly it wasn’t terrible for my account).

The first thing is that despite the fact I completely wiped my yearly profits in just a couple of days I continued to trade and as you can see from the chart I actually was pretty aggressive in my positioning as I was loosing money.

One caveat : As this account contains positions in Stocks some of the drawdown visible above include bad stock bets like DB and Kroger, which are underwater at the moment and are counted towards the chart despite the fact they aren’t booked. In other words the chart is based on Equity movement from account value not booked P&L.

Mistake number 1:

I was trying to compensate for lost profit by increasing my leverage, something that is never a good idea and despite the fact I know this all too well I kept on doing.

Lesson: Keep your risk & leverage fixed and never increase your risk especially if you are on a loosing streak.

Mistake number 2:

I was trading way too much in an attempt to cover for the drawdown, mostly a result of being pissed at the market, but as well all know the market is always right.

Lesson: It is usually wise when you have had such a bad run that you wiped 2 months of work to actually stop and give yourself a break.

Even more it is often the case that one trade with a larger stop will yield net more positive effect than a lot of trades. This applies for both winning and loosing trades on an average basis. For example, if you take 5 trades with 10 pip stops you might as well take 1 smaller trade with 50 pip loss and save yourself the commission costs especially if you attempt to re-enter as soon as you get stopped out. If you get stopped don’t re-enter straight away, wait for the next level and be disciplined.

While I didn’t keep re-entering trades over and over again because I have had enough experience not to do that, I was adding to some positions with tight stops. What happened was that those trades got stopped and I was left with only my initial position which was with a pretty bad entry (1.23 EURUSD) and once that rolled into the profitability it was basically enough to just cover the loss I incurred in March. The positions that I was adding above 1.23 ended up all getting stopped because I was going for larger leverage than usual on those and I wanted to keep risk tight.

What would definitely have yielded better result was to not add a bunch of trades as EURUSD was going higher with decently chunked leverage, but add 1 position that was smaller with considerably larger stop still within the acceptable loss range as I did with the trades I was adding.

Today we had the first real unfolding of my bias and I have went back into making the profits I had in February, however, if we look at this whole movement on the P&L chart what I did is basically loose two months on a stubborn bias and despite the fact that I ended up being right I was no better than I was in February.

This how it looks with the update for the unfolding:

It should be noted that it was only when I started trading properly middle of April that I started making back the loss. I cut down the number of trades I was taking and the position sizes. Without the strain of having to deal with high-risk positions I was trading a lot better.

Now that most of the USD upside has unfolded I feel like I have literally lost 30 days + of work on nothing instead of profiting from the move significantly I barely made anything extra and while I am obviously happy I recovered the drawn down it is also really terrible to see that despite the fact I had such strong conviction in the direction of the market I literally did nothing out of it.

It is a bit of a different post than my usual stuff, but I decided it was worth sharing and mostly because it is always a good idea to write down your mistakes.

I will do another post on my view on the markets soon, however, most of my first and second targets are hit and now very little of my positioning remains for 1.17 in EURUSD and 1.32 in GBPUSD.

I have entered a short EURCHF trade with small size and tight stop just a bit above 1.2 looking for 1.18 and I am waiting for an entry opportunity to short USDJPY.